Predictive Analytics has the power to revolutionize almost any industry. It’s especially useful for financial institutions like banks and fintech firms because they help gain access to the subconscious behavior of customers. This includes their spending and saving habits, social habits, and more. We can use this data to personalize service for customers and customize products based on their preferences.

Arguably, the most valuable benefits can be found in lending and recovery. Most banks can give loans to people with minimal documents/proofs of income. It’s a highly profitable business, and the majority of lenders are in the automobile and personal loan space. However, this kind of business is risky.

Banks can mitigate these risks and streamline the entire lending process with the help of predictive analytics.

Let’s take a look at some of the processes that can be helped:

Setting Interest Rates

Using historical data, a lender can determine the probability of an applicant to pay back a loan. The applicants can be segmented into three categories: Low-Risk, Medium-Risk and High-Risk. The lower the risk, the lower the interest rates.

For first-time applicants, banks need to be more cautious. Applicants’ demographic details such as age, salary, marital status, and number of dependents can be used to predict the risk levels applicants belong to and finalize their interest rates for loans.

For regular applicants, it’s easier to predict risk levels. Leveraging historical data from other financial institutions from where these applicants have taken loans, banks can obtain their credit scores.

Although financial institutions do their research before disbursing loans, many people default either willingly or due to some circumstances.

To overcome such issues, they can use predictive analytics even in the money collection/recovery process.

Selecting the Right Recovery Methodology Based on Propensity to Pay

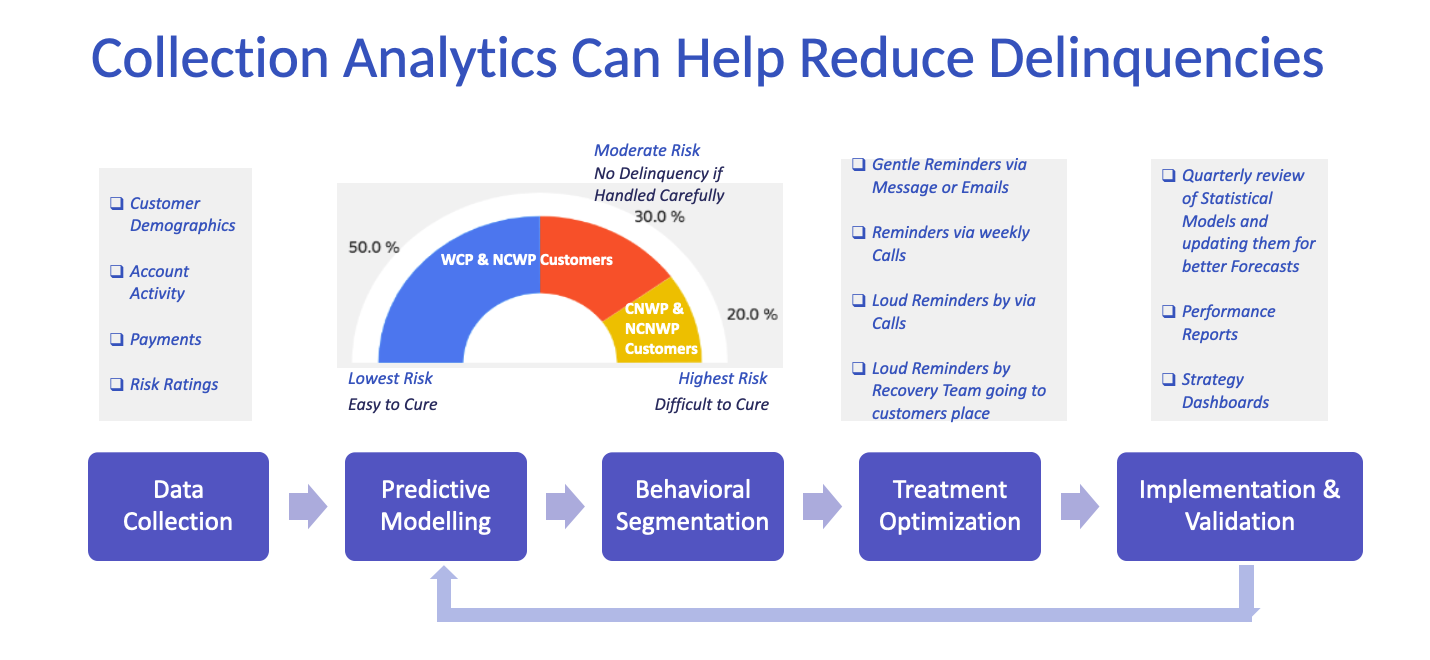

Delinquencies are a major issue with “No Security Loans.” Using predictive analytics in banking, lenders can predict the propensity of each customer to pay back the loan. This process is known as Collection Analytics. Here’s how it works.

Using the data collected from various sources, banks can predict the PD (Probability of Default) for a customer. Thereafter, based on the amount of money they have borrowed and the duration, the ECL (Expected Credit Loss) can be calculated.

ECL = EAD * PD * LGD

Once the ECL for each customer is obtained, creditors can decide the kind of treatment the customers should be given based on their ECL score.

Based on this ECL score, the customers are segmented into various profiles such as:

- Capable & Willing to Pay (CWP)

- Not Capable & Willing to Pay (NCWP)

- Capable But Not Willing to Pay (CNWP)

- Neither Capable Nor Willing to Pay (NCNWP)

The first two categories (CWP, NCWP) of borrowers are safe, paying back fully in most cases. But the last two categories (CNWP, NCNWP) are quite risky. 50% of the cases in these categories will not end in payback, and should be given relevant treatment.

Although CWP & NCWP customers are 80% of total credit issued, the other 20% is just as valuable. If CWP or NCWP customers miss an EMI, they are likely to pay back after a single message or phone call or some extra days.

CNWP or NCNWP customers are very unlikely to pay even after a message/phone call/extra day. To recover money from such people, creditors need to hire recovery agents or file lawsuits against the customer.

This Collections Analytics process is iterative, and should be done every quarter or based on business requirements.

The above process helps in Credit Portfolio Management by suggesting the right kind of treatment for particular customers. Hence, Collection Analytics helps lenders succeed by:

- Reducing receivables balances.

- Increasing operational profitability.

- Making sure that bad accounts are not repeated.

Learn more about how you can leverage the capabilities of predictive analytics in financial services.