There’s a big difference between knowing and doing. As Leonardo Da Vinci put it, “Knowing is not enough, we must apply.” His words rang true in the 16th century, and they are just as applicable in the digital age. When applying this to a sales forecasting process we can either just use the forecast to monitor the sales team performance or leverage it to influence and increase sales.

For organizations that want to enhance their sales pipeline, the use of artificial intelligence and machine learning to surface key insights and make data-driven decisions is only half the battle. To drive real ROI, implementing smarter solutions and enhancing business processes so that they are more efficient is a must. In particular, results from sales forecasting models can drive actions that can improve business operations and outcomes.

A Primer on Forecasting

When designing an intelligent, data-driven sales forecast, we consider two different methods for forecasting. Top-down approaches use traditional time series methods to calculate an aggregate-level forecast and are especially helpful for generating a top-level view of quantities like total revenue. Top-down approaches are particularly effective when the current forecasting environment is similar to the recent history. However, the top-down forecast will miss unusual or abnormal events or changes in the macro-environment. To help identify the effect of these changes we turn to a bottom-up, deal-driven forecast.

Bottom-up forecasts score each individual record (typically a sales opportunity or lead) with a predicted probability of conversion. By multiplying the probability times each deal size, you can calculate an expected value that can be rolled up for teams, regions, or any meaningful aggregation. Environmental changes are then reflected in a smaller or larger than usual deal pipeline.

When Forecasts are Below Quota

Traditional forecasting methods may help managers know when sales aren’t quite tracking vs the quota, but outside of encouraging their sales reps to find opportunities or call in favors, they aren’t equipped with many new tools for improving outcomes. In contrast, with intelligent forecasting, a manager can look at key insights related to factors that impact the likelihood of deals to convert.

Consider this scenario. A manager sees that his sales team is lagging about 1 million dollars behind quota in the given quarter. By using the bottom-up style propensity forecasts, he can identify which deals have a higher chance of conversion. Rather than telling his sales reps to waste their time chasing leads that aren’t qualified, he can work with his team to systematically target the highest-scoring opportunities in the pipeline. Moreover, for each deal in the pipeline, his team can use the intelligent forecasting model to identify actions that have the potential to improve the chances of deal conversion. Smarter forecasts can, therefore, help organizations stay on quota by identifying the best deals to target and the most efficient strategies to convert them.

Early Warning Systems

The framework provided by both bottom-up and top-down forecasting also allows for relatively easy implementation of an early warning system. With better forecasting, potential shortfalls or problems can be identified earlier, providing organizations with more time to get ahead of the problem. For instance, consider a company that repairs and ships automobile parts. Delivering parts on time is often paramount, but supply shortages and other issues can cause parts to be late. A model that identifies which parts are placing the timeline at risk would be useful; however, the critical component of a useful forecast is when that information becomes available (knowing a part will be late a day before it is supposed to be shipped is of little use). Better forecasting models can enable early warning systems that identify problems earlier, giving the organization more time to react and adjust.

These tools can be built using a variety of systems; however, by using Salesforce’s “Action Framework”, implementation is easy, and information/warnings can be surfaced quickly in front of the people who most need it. Top-down style forecasts can be generated using tools like Einstein Analytics timeseries function, which can be used to build dashboards. Tools like Einstein Next Best Action can then be used to generate automated flows of actions based on forecasted values. When top-level forecasts fall below a certain threshold, triggers in Salesforce can be used to surface warnings (and suggested actions) to the people in the best position to solve the problem.

Similarly, bottom-up propensity forecasts can be generated using Einstein Discovery, so each opportunity’s likelihood of conversion can be calculated. Early-warning systems could be developed to automatically identify when a predicted conversion score goes below a threshold, notifying either a rep or manager and providing them with a list of suggested actions to help solve the issue.

Identification of Sales Behaviors

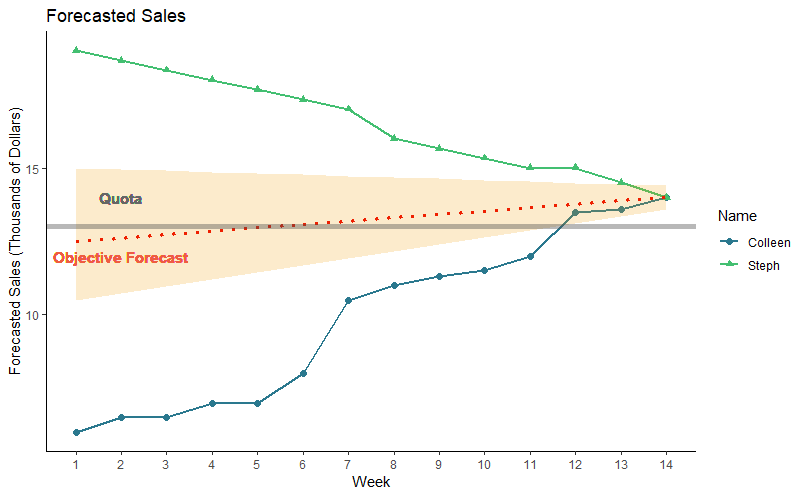

Let’s consider a sales organization that has two great salespeople, Colleen and Steph. Both are terrific at converting deals, managing their pipeline, and (eventually) driving sales. Each week, Colleen reports on her pipeline with a little bit of caution, hedging how close each deal is to converting. By contrast, Steph has never seen a deal that she couldn’t convert – her weekly reports are overly optimistic. These behaviors are quite common in sales organizations, but traditional forecasting methods often don’t account for them, much less allow for managers to identify or quantify them.

Traditional sales forecasts might get built like this:

- Steph and Colleen rate each of their deals based with a “probability” score based on their gut feel and progress

- They also report an expected deal size

- Deal sizes are rolled up to their manager for an aggregate-level forecast

So where does this method go wrong? Well, if we are at the beginning of the quarter, our two salespeople may have radically different ways of thinking about that subjective “probability” score – Steph may be over-estimating the true likelihood of a sale whereas Colleen might be underestimating. As the end of the quarter approaches, they may make substantial changes to their subjective forecast to get closer to either the quota or their actual pipeline, but that bias could substantially impact forecasts early in the quarter. Therefore, even if their sales end up identical by the end of the quarter, they may have very different sales forecasts earlier on.

A bottom-up style forecast, like the one shown in the red dotted line in Figure 2, instead estimates data-driven predicted probabilities of success, providing a more objective, consistent way to estimate the likelihood that a deal will convert. A more accurate forecast – plus a range of plausible values – is available earlier in the quarter. Moreover, comparing those objective opportunity scores to Colleen’s and Steph’s subjective deal probabilities will unearth their behaviors and help their manager to identify when and where they are systematically over/underestimating deal values.

Final Thoughts

By building better, more precise forecasts, we can give decision-makers a way to make more consistent decisions and identify efficiencies in their business process. However, true gains are only made when managers are empowered to act on the insights they identify, enabling their reps to convert deals faster/more consistently, and enabling their teams to be more efficient. Using smart forecasting coupled with an intelligent “Action Framework”, managers can better understand sales team behaviors, develop better ways to stay on quota, and get ahead of potential pitfalls that lie ahead.

If you haven’t read Atrium’s Forecasting Whitepaper or my other blogs on forecasting (Top-Down vs. Bottom-Up and Driving Forecasting Value with Intervals), these are a great reference for a deep dive into the differences between top-down and bottom-up forecasting approaches. Are you using smart sales forecasting tools? Have questions about forecasting? Atrium can help!