Authors: Trey Worley; Dr. Kenny Flagg; Paul Harmon; Corey Maxedon

What is customer lifetime value supposed to measure?

Customer Lifetime Value (CLV) has been a staple marketing concept for decades. In brief, it allows companies to assess the monetary value of a customer for the entirety of the transaction relationship. This entails a shift from thinking about leads (achieving a first purchase or establishing a relationship) to thinking holistically about the customer journey.

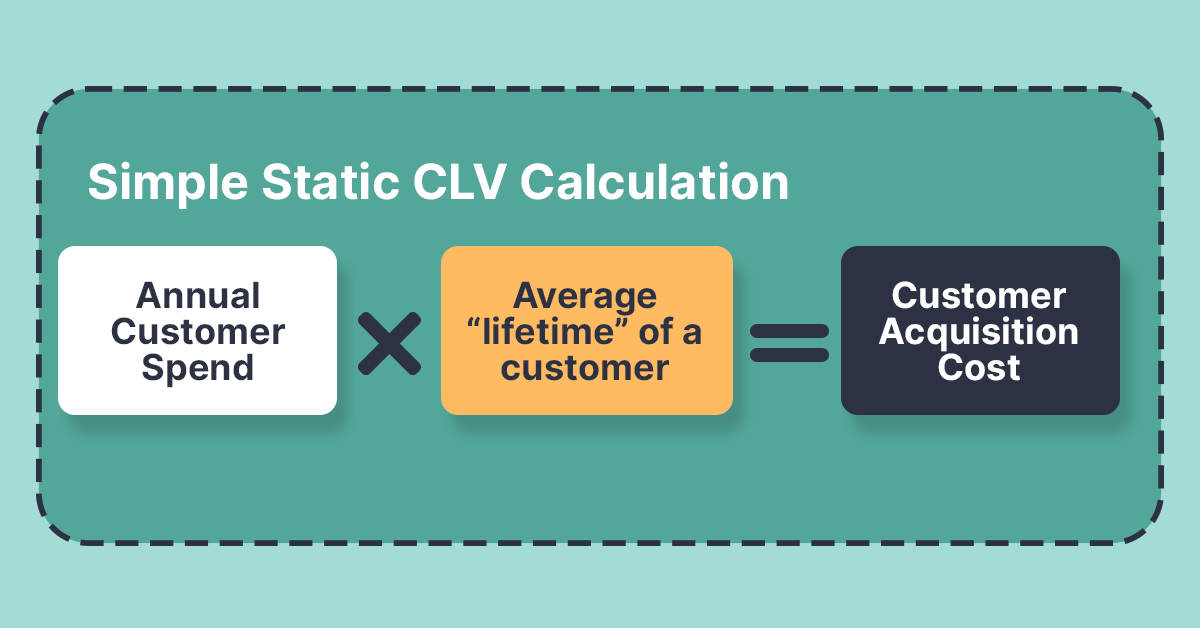

The goal of CLV is to put a number on the total value of all purchases, including both past purchases and unrealized future purchases. The classical approach to calculating CLV is simply a blanket formula that incorporates average revenue per customer, average cost of acquiring and retaining a customer, and retention rate for the entire customer base. It uses only historical data, without any future predictions of customer spend and retention.

This approach assumes homogeneous purchase frequency and attrition rates across the entire customer base, which has three main pitfalls:

- Too general: Individualized CLV calculations can not be realized

- Inflexible: Averaging over an entire customer base’s history is not flexible enough to incorporate recent changes in purchase behavior

- Static: Calculations are based on historical information and cannot easily be updated in real-time

There are several ad-hoc ways to use these ideas. However, using modern statistical methods to calculate CLV on a customer-by-customer basis creates more business value.

These techniques involve predicting, for each customer, three pieces of information:

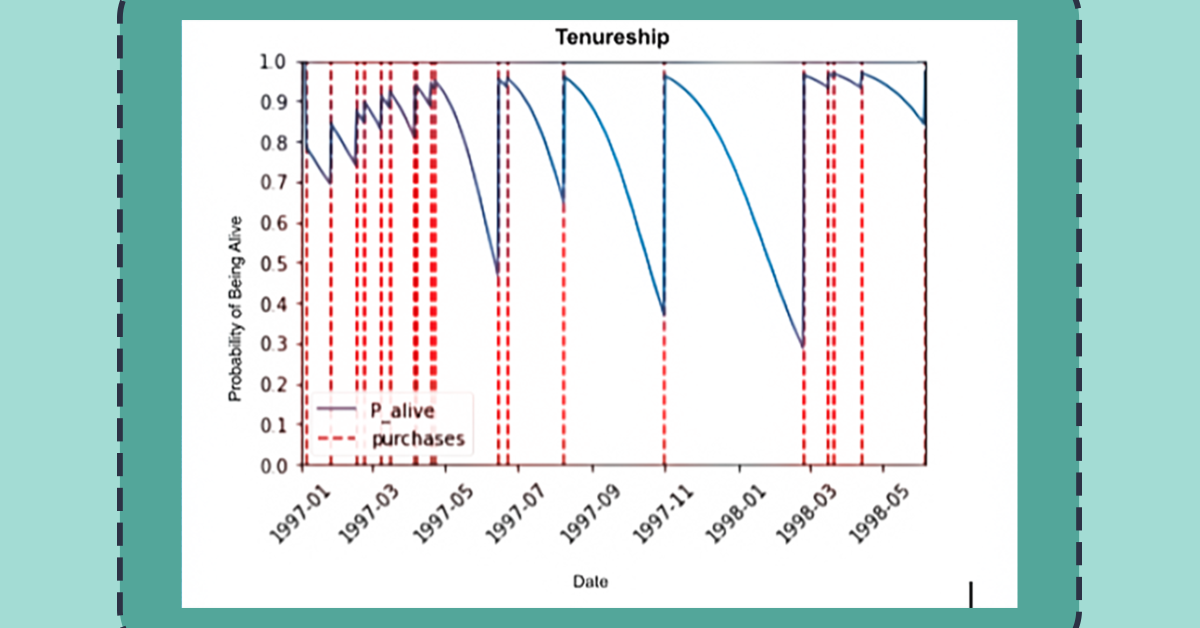

- Tenureship: how long will a customer remain a customer?

- Purchase frequency: how often does a customer purchase?

- Spend: how much does a customer spend when they purchase?

With these three variables, combined with general information about the customer base as a whole, we can model the expected Lifetime Value for each customer and update it in real-time. This Lifetime Value is essentially predicted spend for each customer, weighted by their individual attrition risk and purchase rate. Additionally, predicted tenureship and purchase frequency can inform strategic CRM decisions themselves.

A modern approach to customer lifetime value

The biggest problem with traditional CLV calculations is that they are fixed in time, assuming that monthly volume from a customer will continue in perpetuity. Probabilistic modeling techniques allow us to incorporate future behavior into today’s customer value ranking, something that current formula-based methods simply cannot do well.

Our approach involves estimation of three critical components:

- Predicted spend volume: How many transactions do we predict a customer will make?

- Probability of purchase: What is the likelihood (0-100%) that a customer will make a future purchase?

- Spend amount: What is the forecasted amount that we expect a customer would spend in a transaction?

By combining historical behavior of each individual with historical behavior of entire customer base, we can predict future values of these 3 for each individual metrics. Each one of these individual models can be useful on their own, but combining them together provides a powerful, robust system for predicting customer lifetime value.

“CLV is not a formulaic calculation”

How can you use CLV in an intelligent experience?

In order to support ongoing revenue, every sales organization faces various cross-pressures. Sales representatives and managers need to generate business with net new customers, support sales growth and cross-sell within existing accounts and minimize churn among at-risk accounts. But with limited resources, organizations need to make choices about how much time to expend on each activity and prioritize targeted activities. An intelligent experience built around CLV can help drive this prioritization in a manner that is driven by data.

How much revenue will a new customer contribute to your organization, and over what period of time? How much time does it generally take to convert leads into accounts? What level of revenues will be lost if attrition-aversion measures aren’t taken with a specific account? A holistic approach to revenue management should take these questions into account, and a crucial component in the first and last question above is understanding CLV. This approach might result in various activities, such as:

- Account prioritization: Ensure saveable and impactful customers are being retained

- Lead-vs-acquisition effort balancing: Identify the right balance of acquiring higher-cost leads vs. providing additional support/nurturing to potential customers

- Account segmentation: Generate specialized teams or tactics based not only on account types, but also CLV considerations.

How can CLV solutions impact your business? Consider the following situations where important business processes can be positively impacted with smarter, data-driven understanding of customer buying patterns. These are presented below in a user-story-based format:

Executive forecasting

As a sales executive, I need an intelligent forecasting process to determine future customer behavior (spend/attrition/retention) in order to proactively plan for current business roadmapping. With those tools, I can see how business is growing and highlight components of the business that are lagging behind.

Retention-related activities

As a customer service specialist, I need to be able to proactively identify at-risk customers so that the business minimizes customer attrition. CLV will help in determining an appropriate amount to spend on customer retention through knowing a customer’s lifetime value, and might help with allocation of front-end marketing spend as we prioritize different sources for leads. Examples of questions that we might be able to address include:

- “Does giving out promotional coupons/gift cards/etc. in the present pay off in future customer spend?” (CLV).

- “Where do investments in front-end marketing yield the healthiest long-term customer relationships?”

- PAlive plot as a visual (tenureship).

Sales manager

Based on CLV and tenureship for the current customer base, as well as estimated CLV from new customers, I will prioritize when and how I work with customers (tenureship, CLV).

CLV tools that highlight and understand changes in predicted buying trends within segments of my business to identify attrition risk early (tracking tenureship and CLV at aggregate level), and identify save or growth activities based on segment. (cohort analysis on tenureship, frequency and spend) These insights can help me to work with my team of sales reps to be more efficient and better informed in the future.

Enhance the intelligent experience with CLV

Understanding how and when customers will transact is critical to driving efficiency in business. CLV can help organizations be efficient in how they leverage finite resources to work their customers, knowing who to prioritize and understanding transaction behavior.

At Atrium, we help our customers to make better decisions using data, designing intelligent systems that help them to acquire and retain customers in the long term. We have a dedicated history of designing, building, and enabling intelligent solutions for customers that reduce customer attrition and maximize the value of current customers.

Implementing CLV models as part of an intelligent experience can help an organization to enhance operational efficiency and create a better, more streamlined experience for their customers. For more questions about predicting customer lifetime value and how it can help your business, let us know here.