When companies start focusing on customer retention, most find that they are playing catch up in several ways. Seeing customers leave is one thing and understanding why is another, but the critical thing that companies struggle with the most is developing methods to proactively address customer churn. Many organizations have developed some version of a retention strategy, but most rely on anecdotal evidence of churn success stories and similar best practices to inform it. However, with the aid of AI and machine learning, companies are beginning to understand and use their data to solve these progressively complex challenges.

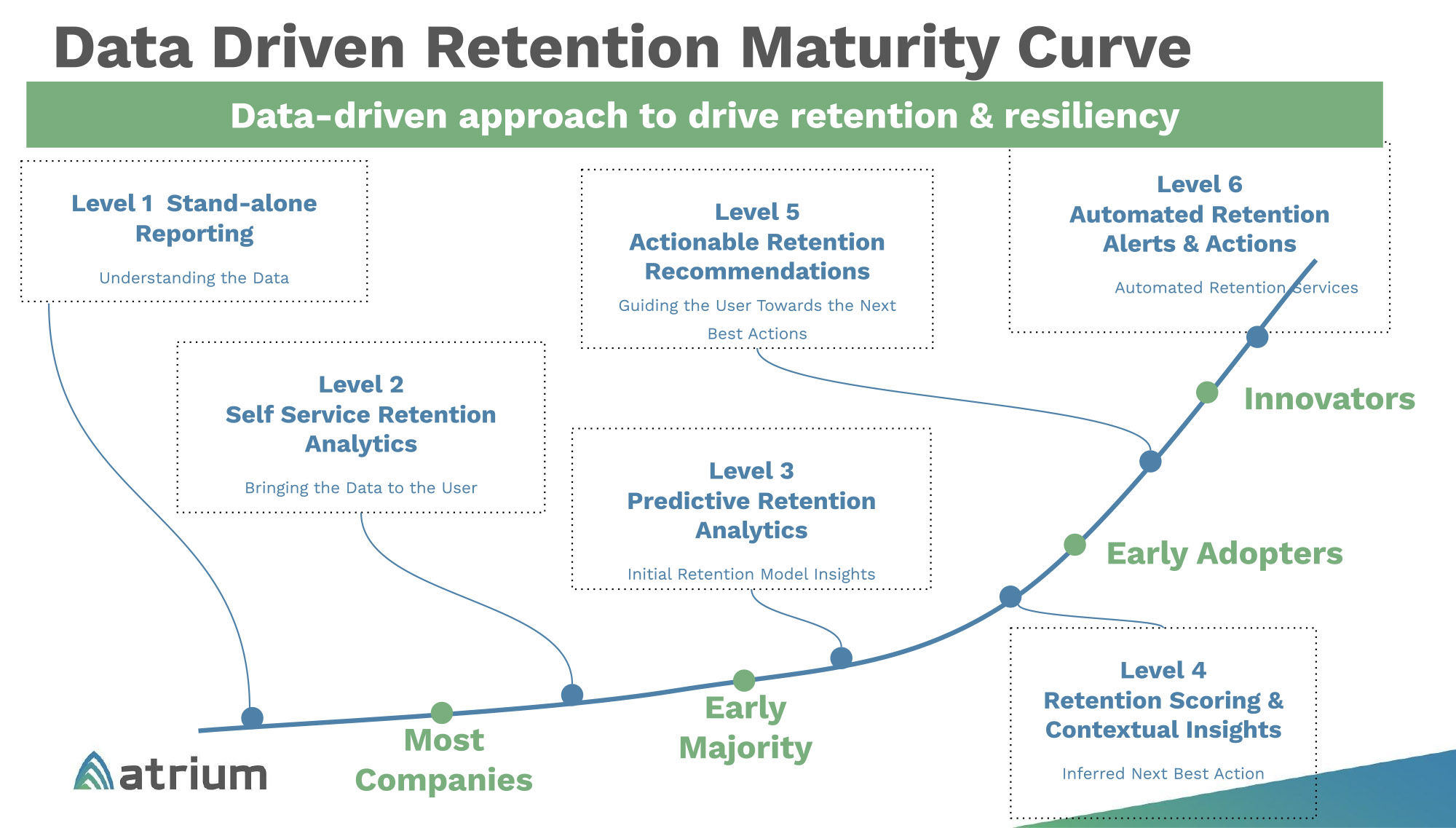

Improving Customer Retention With a Journey Up the Maturity Curve

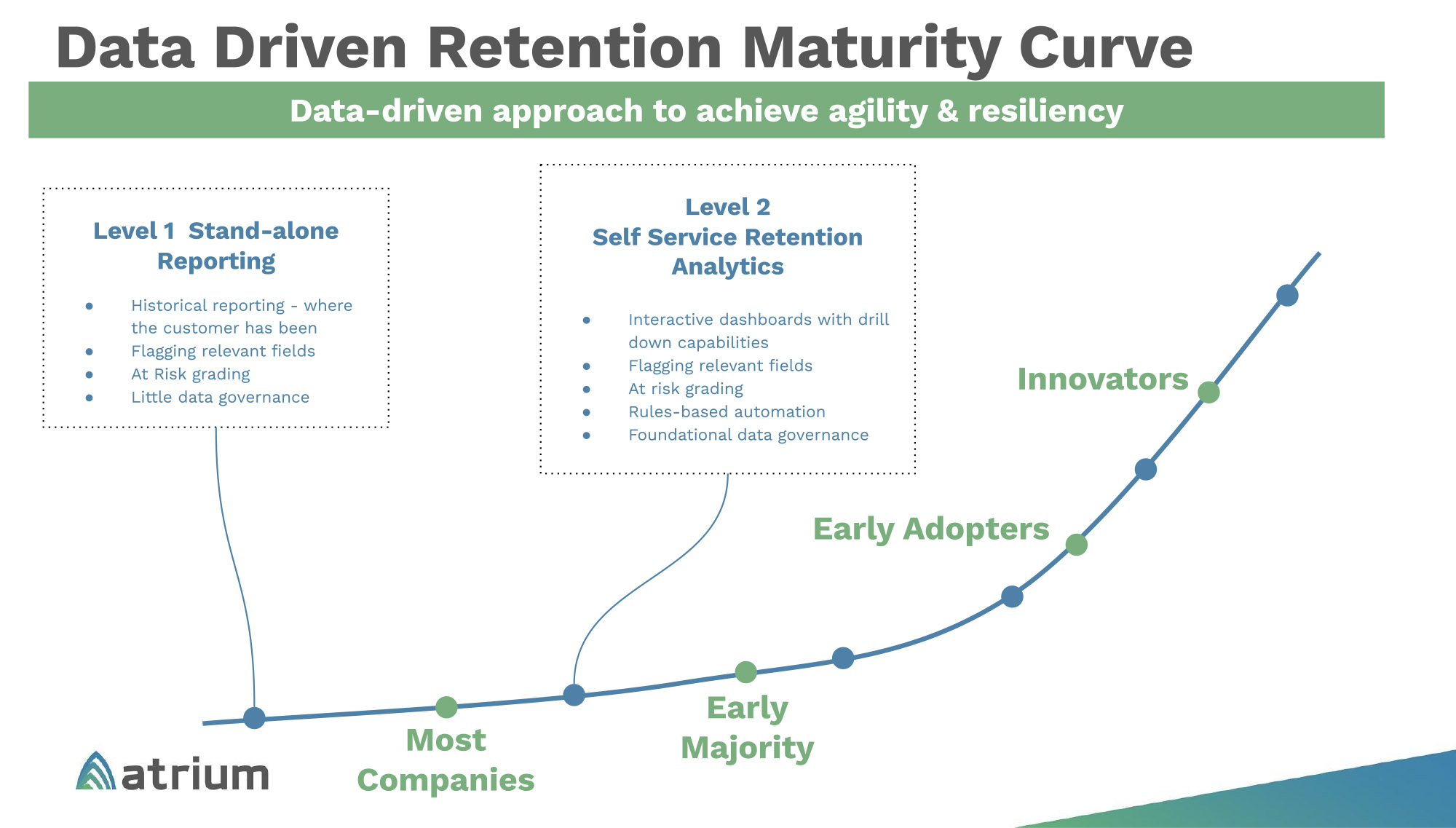

To achieve a true solution around addressing customer retention, companies should assess the current maturity of their systems of intelligence to start planning future development strategies. Maturity can be determined through a set of milestones or stages that help measure progress towards that ever elusive goal: improved customer retention.

Each milestone represents a combination of reporting features and tools that can be leveraged to expand a company’s retention efforts. To start this journey “up the curve,” let’s discuss the first two stages that represent a majority of organizations today.

Most Companies: Level 1 and Level 2

Almost all organizations have some sort of reporting that provides insights into customers that have left over a specified period of time. Furthermore, most have a version of a “retention desk” or customer service agents who focus on retaining customers at the time of their cancellation request. However, as one may guess, this is extremely reactive and most likely too late in the retention lifecycle to make a meaningful impact. At this point, the customer has already made the decision to leave, so trying to convince them otherwise will prove difficult — just ask any retention agent!

If there is a retention desk, they may be working off of a list of recently churned customers, performing outreach tasks, and “re-selling” them on why they chose to purchase goods or services from your company originally. The challenge of working with this type of standalone reporting is that it can be time-consuming, outdated, and in most circumstances, require the assistance of an in-house business intelligence team. Unfortunately, this takes the retention specialist and their manager away from the first priority — the customer — because they need to spend time analyzing and understanding the data.

To improve the quality of data and access to it, many organizations have equipped their teams with self-service analytics tools designed toward identifying at-risk customers. With this type of reporting, the user has more control because it allows the agent to drill down into details pertaining to the customer’s account. This detail provides meaningful insights into what some of the leading data indicators are that cause a customer to churn. Though what is concerning is that the agent is still responsible for taking action, which requires providing each agent with best practices.

So while the information around customer churn is more readily available to the user, there are still many unknowns around whether the appropriate actions will be taken, not to mention any undiscovered insights. How do we account for these things?

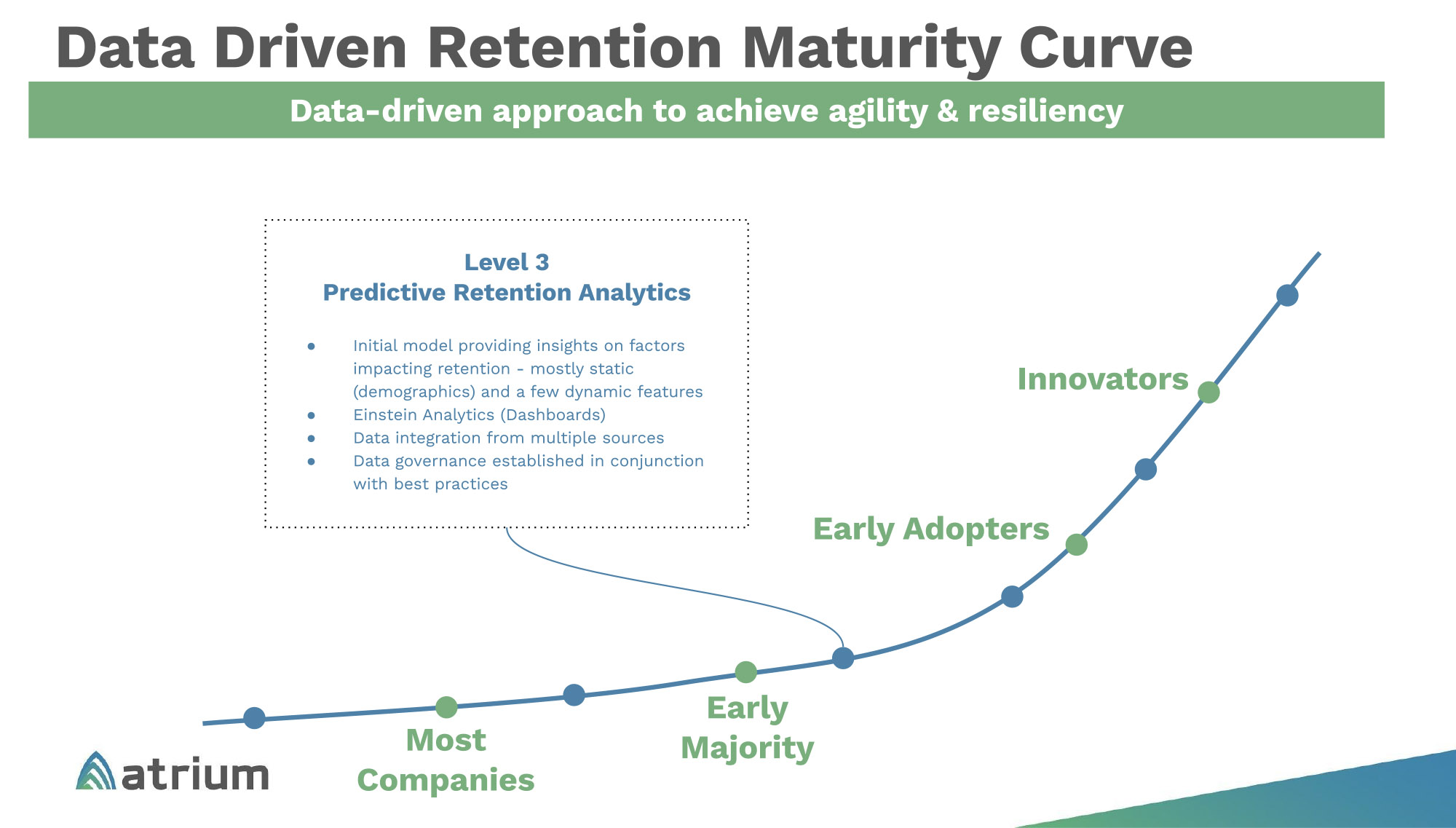

Early Majority: Level 3

This is considered one of the more progressive stages of customer retention maturity, where some companies have already moved or are in the process of moving to. Expanding on their business analytics, companies are starting to create their own data science teams to explore their data and uncover trends that could be impacting customer retention. Companies reaching this milestone will have an initial model that examines mostly static features (think demographic, firmographic, etc.) and some dynamic features, also called engineered features. These engineered features are calculated from existing data and, when combined, provide real insights as to what is influencing retention rates.

This model usually pulls data in from multiple systems to allow for a more holistic view of the customer experience through their initial onboarding, their order history, and their customer service interactions. All of these features can be combined to uncover previously unknown issues or challenges to retain customers. As the early majority starts getting traction, they can look toward the future by beginning to add in contextual insights that will drive them further up the curve.

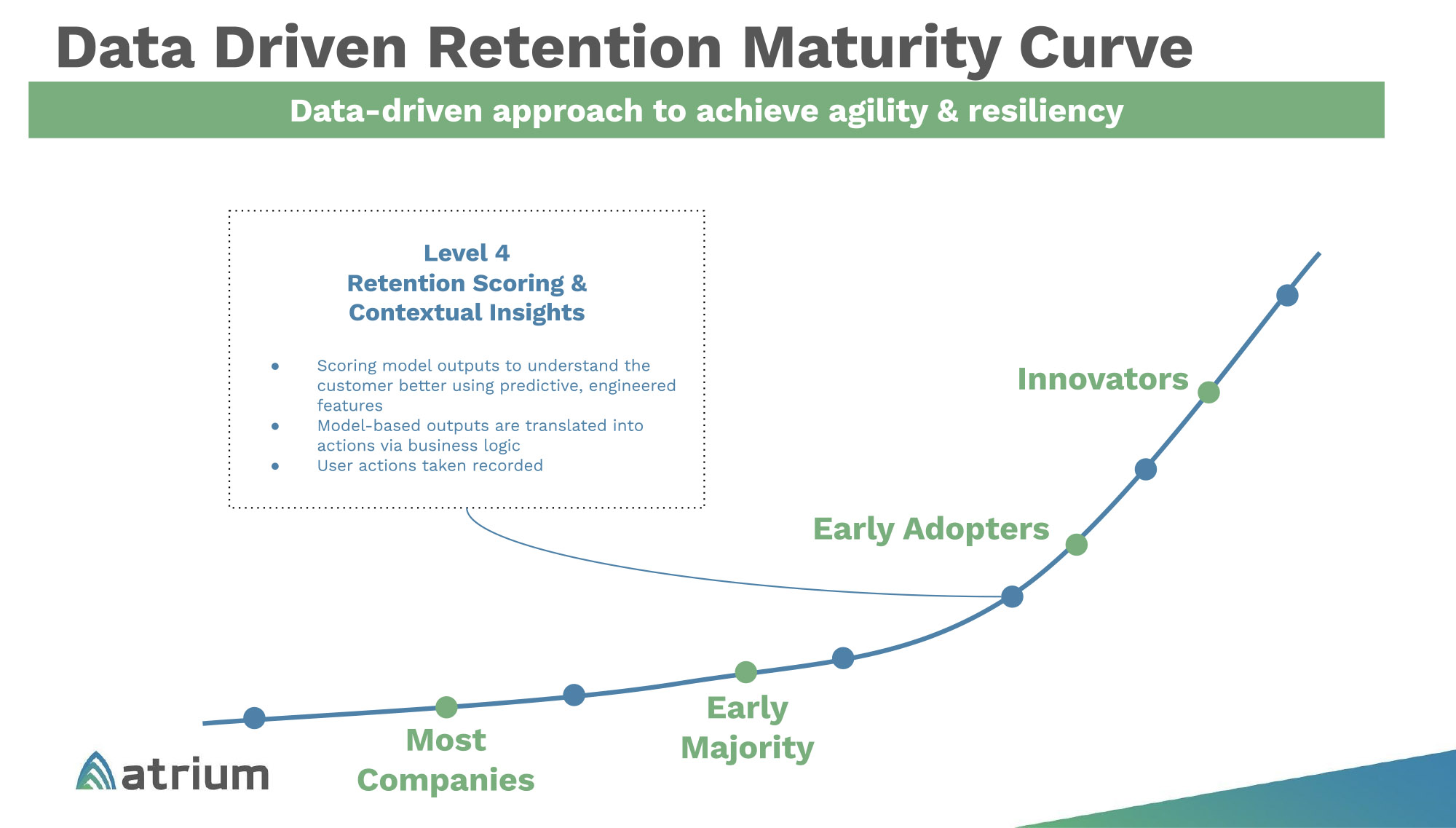

Early Adopters: Level 4

When moving past predictive analytics, models use more engineered features to better predict the likelihood of customer churn. These models also provide organizations the ability to assign a score to each customer to help prioritize the retention user’s daily activities. Instead of the user reacting to a cancellation request in real time, they can use a prioritized dashboard to structure their day to avoid those uncomfortable conversations altogether. We’ve now moved from reactive to proactive strategies, attempting to solve the “issue” before it occurs. By using the engineered features, the model is able to highlight the top reasons for the score and the percentage impact each is having on that score, all the while creating the foundation for turning those insights into retention plays.

But even though we have more information about why the churn could happen and what’s impacting it, how can a user act on this valuable data? Experienced retention users will know just what to do because of their past experience, but what about your new hires and those who might struggle to apply the right solution at the right moment? Some companies are starting to put these insights into action or even automation. Moving them toward the next two milestones could represent the biggest return on the investment.

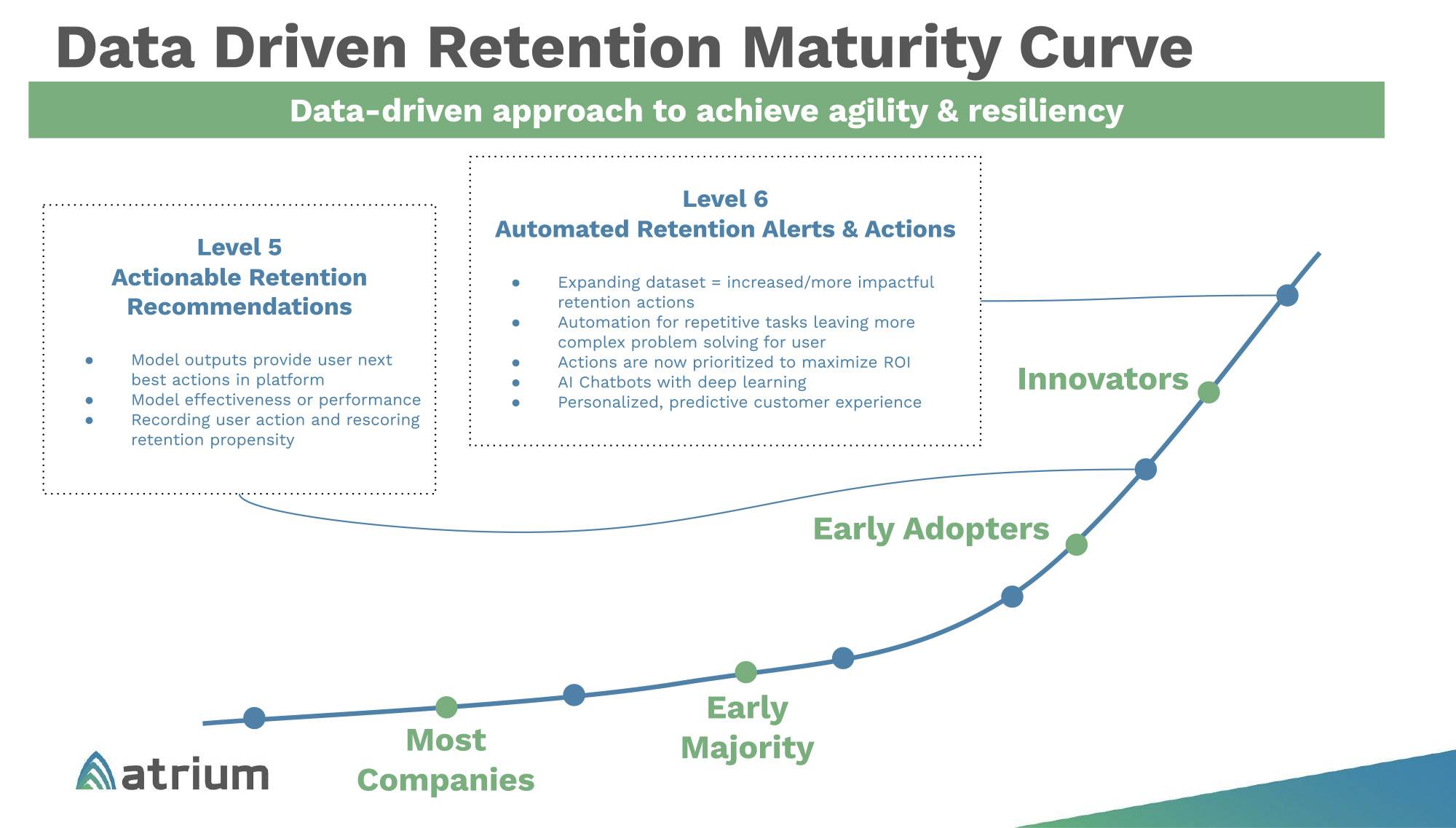

Innovators: Level 5 & Level 6

This is where companies move to the forefront in comparison to most of their peers, because customer retention is all about action — where it happens and who’s doing it. Up until this point, we’ve been focused on understanding the data, creating the model, and determining how to use it. Now it’s time to build the strategies. These are based on the model outputs and can be combined with business rules to handle myriad scenarios. This is where the recipe for success starts to come together — marrying the data to the recommended action for a representative.

For example, let’s say a predictive retention model has shown us that customers who ordered their product online with no agent interaction and did not have a certain feature activated are more likely to attrit than those who added the feature. While the customer is yet to complain, we know there’s a stronger propensity that a cancellation may be on the horizon. With these key pieces of information, a strategy can be built to immediately address the issue before the customer has a chance to start down a churning pathway.

Remember that prioritized dashboard we created in early stages? Now we can use that same dashboard to take immediate action directly in the CRM. We no longer need to look at the report and then pull up the account and make a call. Instead, the retention agent can now see the insight about the missing product feature that’s putting this customer at risk. They can also accept the recommendation and add the missing feature to make the call as needed. Taking it a step further, the business owners can create rules (e.g., scripting, required data review, content sharing) to follow based on the model output.

We have come so far in this journey but it’s not over just yet. Besides, let’s be realistic — it never will be, because businesses and consumers evolve, as do their subsequent needs.. This means that the model must learn and adapt while the business must continue to focus on how to create the best customer experience. The true Innovators are taking the model insights and turning them into action by introducing automation in the next best action. Their datasets are growing, offering more impactful insights and allowing for more creative actions. Think about our missing product feature; the customer logs in to manage their account online. Since they are relatively new to your company, they are not asking about a refund or complaining, they are “just” a customer right now. But how will they feel when they receive an automated alert on their account page about the missing feature? If it stops there, they probably won’t be very happy because you appeared to pull a fast one on them.

Thankfully, our innovator company put a strategy into practice in the form of a button that allows the customer to activate that feature online without ever having to speak with an agent. Once the customer clicks “activate,” the model will rescore the customer’s retention propensity, which will increase due to the simple action. All of this happened well before the customer ever had a chance to have a bad experience. By allowing the customer direct action, you have also saved the valuable time of your retention user so they can spend time solving more complex customer issues.

Start Your Data-Driven Customer Retention Strategy With Atrium

The data-driven retention journey has to start somewhere. Whether your company is working off of spreadsheets, using dynamic dashboards, or modeling customer attrition trends, there is opportunity to improve. Every company’s journey to retain their customers is unique, as it is directly tied to their changing needs. To stay ahead, they have to enable their agents and systems with the most effective tools and information. Ask yourself, where does your company sit on the curve and what do you need to do to become an Innovator?

Watch our on-demand webinar on using analytics and AI to drive customer success and reduce customer attrition.