You’ve no doubt heard that it’s more cost-effective to keep your existing customers than it is to acquire new ones. But even with the most successful data-driven customer retention efforts, most businesses still need to attract new customers and reach new target markets to sustain growth.

The real cost of customer attrition is complex, with research to support the idea that acquiring a new customer can be anywhere from 5 to 25 times more expensive than retaining an existing one. Let’s unpack the true customer acquisition cost for businesses, and understand new customers as opportunities to scale.

Calculating Your Customer Acquisition Cost

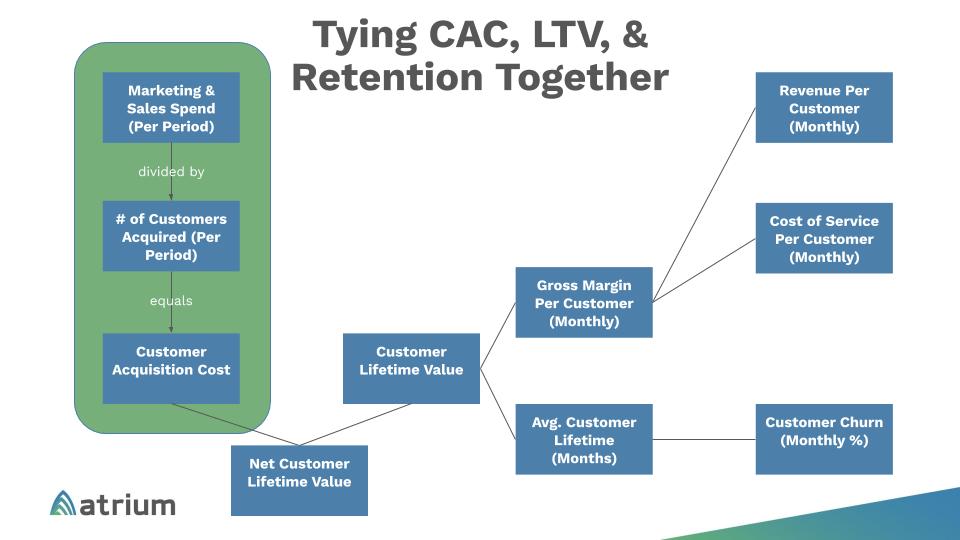

Neil Patel explains the math behind customer acquisition cost as such: it can be calculated by “simply dividing all the costs spent on acquiring more customers (marketing expenses) by the number of customers acquired in the period the money was spent.” So if you were to spend $50,000 on marketing and sales in a year and acquired 150 customers in that same year, your customer acquisition cost would be ~$333.

Of course, this can differ greatly depending on your industry, if you’ve recently diversified your marketing and sales efforts or changed long-term marketing and sales investments, and other variables. As HubSpot states, there are several expenses that could apply to this metric:

- Ad spend and publishing costs

- Employee salaries

- Creative costs and production costs (e.g., content and video creation, PR)

- Technical costs (i.e., any technology your marketing and sales teams use)

- Inventory upkeep (e.g., updates and patches to your products or services)

A Customer’s Lifetime Value in Relation to the Initial Customer Acquisition Cost

The time and money you put into acquiring a new customer is time and money that could be spent elsewhere — on improving or adding to your roster of products or services, on nurturing your existing customers, and so on. It’s important to know a customer’s lifetime value, in addition to the cost of acquiring them in the first place.

Qualtrics gives advice for measuring customer lifetime value by identifying and measuring key touchpoints along the customer journey, like so:

- Identify the touchpoints where the customer creates the value

- Integrate records to create the customer journey

- Measure revenue at each touchpoint

- Add together over the lifetime of that customer

To that end, the actual equation for customer lifetime value is: customer revenue per year multiplied by duration of the relationship in years minus the total cost of acquiring and serving the customer. Whereas customer retention is closely tied to a healthy customer lifetime value — think loyalty programs and subscription services — a cost-effective customer acquisition cost is equally important in keeping your business trending in the right direction.

For instance, if the customer lifetime value of an independent bookstore customer is $1,500 and it costs more than that to acquire them through ads online, discount days, etc., the bookstore could likely be losing money… unless they can reduce the cost of acquiring that customer.

In getting smarter with marketing and sales spend, businesses stand to reduce customer acquisition cost (as well as churn) without negatively affecting the customer experience. But where do you begin to cut acquisition costs and more cost-effectively collect and leverage data about prospective customers?

Reducing Your Customer Acquisition Cost

CRM and AI-powered solutions can help you harness the knowledge of your different customer types, adding a predictive element to help guide customer interactions going forward. If you want to attract and understand prospective customers, you may consider implementing a predictive lead scoring method. By understanding the economic potential of a prospect from the start, you cut down on the time and money associated with chasing weak leads.

Case Study: Pearson Predicts and Manages Student Enrollment and Engagement

Our customer Pearson needed to identify the driving factors behind student enrollment and retention in Higher Education. With siloed data and incomplete augmented analytic toolsets, analysis stalled. They needed an effective data strategy to support their migration to Salesforce Sales Cloud.

We worked with Pearson to implement Einstein to help them predict and manage student engagement for their customers. Einstein Discovery made it possible for Pearson to identify key characteristics influencing student acquisition, as well as retention. With Einstein implemented, they were able to use those metrics, analytics, and other data they wanted to collect to guide their Sales Cloud implementation. As a result, they were able to show academic partners quantitative data to help prioritize and improve student journeys from enrollment and beyond.

Update Your Customer Acquisition Model

We’ve all experienced global changes to the buyer journey recently, and customer experience is far from immune. It’s time to rework your acquisition model to include cost-effective measures that help lower your overall customer acquisition cost while still understanding and personalizing the customer experience.

Learn more about our services to help you take customer acquisition to the next level.